|

|

This column discusses how, against the backdrop of a strong economic rebound this year and next and the unwinding of emergency measures, the underlying fiscal deficit of the euro area should halve between 2021 and 2022, while nevertheless remaining well above pre-crisis levels. With significant fiscal support still in the pipeline, more targeted measures should avoid excess economic scarring and encourage sustainable growth while facilitating the green and digital transitions.

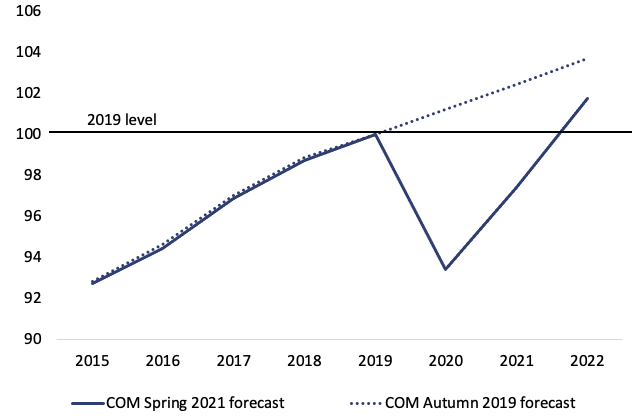

The Covid-19 pandemic caused a sudden and dramatic output contraction in the euro area of about 7% in 2020. Barring a resurgence of the pandemic, the rebound initiated in 2021 is expected to continue in 2022, lifting euro area real GDP back to pre-crisis levels, albeit with considerable heterogeneity across Member States. In terms of annual GDP, few countries will fully recover by end-2021, but nearly all are projected to do so the following year. In its latest assessment of the euro area fiscal stance, the European Fiscal Board (EFB) concludes that national policy plans for 2022 amount to an appropriate fiscal stance for the euro area as a whole.

While it is too early to tell whether the crisis has durably undermined the area’s growth potential, it is likely to have lasting effects on the structure of its economy, with some sectors thriving and others bound to decline. To be sure, contact-intensive sectors have so far taken the brunt and may be more likely to suffer permanent damage. But in such a ‘K-shaped’ recovery, the key unknown is the extent to which lockdowns will have accelerated pre-exiting trends (greening and digitalisation) and promoted the emergence of new business models. These dynamics remain difficult to gauge as the fiscal floodgates remain wide open but will become more apparent as the water gradually recedes. Well-targeted fiscal support can usefully grease the wheels of this complex adjustment process.

Figure 1

a) Euro area real GDP forecasts (annual data)

b) Heterogeneity in recession and recovery

Source: European Commission

The Recovery and Resilience Facility (RRF) can be expected to favour such smart fiscal support over the coming years. The new temporary facility makes up the lion’s share of the Next Generation EU (NGEU) initiative that boasts an overall envelope of €672.5 billion, of which €312.5 billion are RRF grants. An overarching objective of the RRF is to stimulate structural reforms and finance growth-enhancing investments while supporting the green and digital transitions. Aside from the long-term effects, the European Commission expects that RRF grants will already finance €140 billion of government expenditure by 2022, about 1% of euro area GDP (European Commission 2021a). The economic impact of RRF spending will crucially depend on whether the funds are spent efficiently and on programs that would not have been initiated otherwise.

Overall, the economic outlook for the euro area has brightened over the past months but considerable uncertainties remain. Upside and downside risks remain sizable but have become evenly balanced – crucially hinging on the progress in rolling out vaccinations, virus mutations, the extent and nature of bankruptcies and household spending behaviour coming out of the crisis.

The assessment of the euro area fiscal stance provides an important perspective, particularly in the present context. In normal times, the sum of policy recommendations to Member States issued within the EU policy coordination framework usually provides guidance consistent with a broadly appropriate fiscal stance for the euro area as a whole. In contrast, during a severe economic downturn, this is less likely to be the case, even when the severe economic downturn clause of the SGP is activated. This is especially the case when monetary policy rates are at the effective lower bound and some Member States lack of fiscal space. The combined effect of the ECB’s PEPP initiative and the new fiscal instruments at the EU level (SURE and RRF) provided additional flexibility and space for all Member States to respond to the crisis as they saw fit. While, so far, Member States pulled in the same direction, in the ongoing recovery phase stabilisation needs will likely diverge across Member States and the euro area perspective needs to be closely monitored.

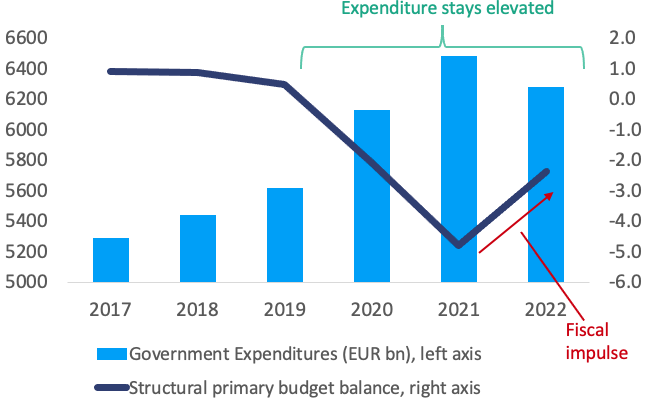

Large jumps in output and consumption complicate assessments of the fiscal stance and its appropriateness by blurring the signal from the annual cycle of government budgets and data. During normal (demand-driven) business cycles, the term fiscal stance is often used interchangeably to either mean the level of support provided by the government’s budget to aggregate demand or the change compared to the previous year. Instead, the peculiar nature of the sanitary shock and the quick fiscal response to it called for an explicit distinction between the overall level of fiscal support (the fiscal stance) and the year-on-year increment or withdrawal of such support (the fiscal impulse).1 In the midst of the crisis, government revenue collapsed whereas expenditure and budget deficits rose sharply. But as the health emergency abates and the economy recovers, revenues automatically rebound and emergency spending sharply falls. Such automatic withdrawal of fiscal support does not make the fiscal policy ‘pro-cyclical’ by any means, it is a mechanical reflection of the shock’s exceptional anatomy. Government expenditure and the budget deficit are projected to remain well above pre-crisis levels.

Figure 2

a) Euro area fiscal stance and expenditure growth

b) Euro area fiscal impulse and degree of economic slack

Source: European Commission

Overall, the fiscal stance of the euro area implied by the aggregation of current policies remains supportive in 2022. The projected structural primary deficit of 2½% of GDP declines markedly compared to 2021 but is close to what it was in 2020 and well above pre-crisis readings. Hence, the contractionary fiscal impulse in 2022 has to be viewed against the forecast of a strong rebound of economic activity and the remaining level of budgetary support.

Three factors further complicate the interpretation of conventional fiscal indicators:

1) The EU-level borrowing for grants is not reflected in the fiscal stance due to RRF grants being recorded as deficit-neutral in national accounts. In the euro area, RRF grants are expected to be about ½% of GDP this year and next.

2) Temporary emergency measures taken in response to the crisis are likely to have a comparatively weak impact on aggregate demand while economic activity is restricted and are less efficient to support the recovery when the health-related emergency gradually wanes (European Commission 2020, 2021b).

3) Public guarantees and the acquisition of private equity are not captured in the budget deficit. Overall, these factors taken together imply a more expansionary fiscal stance in 2022 than conventional indicators would suggest although their precise impact is difficult to estimate.

Against this backdrop, the EFB considers the fiscal stance for 2022, including the contribution of the RRF, to be appropriate. Current policy plans of national governments are sufficient to safeguard the necessary fiscal support for the euro area: emergency measures are withdrawn as the health crisis recedes without jeopardising the economic recovery. In this context, it is important to treat RRF grants as an opportunity to maintain the level of support above what it would have been without the grants. Governments should use them to finance additional investment expenditure and support structural reforms.

As restrictions on economic activity unwind, general measures must be terminated in favour of support targeted to sectors and groups still affected by residual sanitary regulations and to financially vulnerable but viable businesses. Differentiating viable firms in need of further assistance is a challenging but necessary task. The overarching ambition should be to facilitate the transition of the economy, including by assisting and incentivising labour reallocations. Active labour market policies and investment in systems to match vacancies with jobseekers should be a priority. The RRF can help and should be accompanied by a general recalibration of public expenditure towards measures that enhancing the long-term growth potential of the economy.

Although ensuring a sustained recovery remains the priority, sustainability risks have not disappeared. Flexibility provided by the severe economic downturn clause comes with a general condition: Member States are only to temporarily deviate from their adjustment path, but medium-term fiscal sustainability must not be jeopardised. Potential tensions in some sovereign debt markets are currently held at bay, also thanks to a very accommodative monetary policy and the additional fiscal space temporarily offered by the RRF.

It is notable and welcome that the crisis responses by fiscal and monetary authorities have been mutually reinforcing, while pursuing their respective policy objectives. However, this strategic complementarity is unlikely to hold indefinitely. In normal times, fiscal and monetary policy typically produce counteracting effects on aggregate demand. Although the timing of normalisation is hard to predict, its possible effects involve a decompression of sovereign risk premia that would increase borrowing costs of the most vulnerable Member States.

The latest sustainability indicators highlight large fiscal adjustment needs in most high debt countries (European Commission 2021c). In several high debt countries, the annual fiscal adjustment needed to reduce their debt by 10% over the next 15 years clearly exceeds the average adjustment observed in the pre-crisis years....

more at Vox EU