The recovery from the Covid crisis and related lockdowns is likely to be slow due to depressed consumption and investment, and it will require fast reallocations in both the labour market and the capital market. The shock being both exogenous and dramatic, one could have expected European politicians to temporary forget their disagreements. However, even under such obvious circumstances, European coordination has proved as painful as ever and many of old fault lines in the euro architecture debate have reopened. At the same time, a remarkable degree of productive debate and consensus has been forged among economists from all over Europe, which we bring together in a new VoxEU eBook (Bénassy-Quéré and Weder di Mauro 2020).

A remarkable degree of productive debate and consensus has been forged among economists from all over Europe, which we bring together in a new eBook book, Europe in the Time of Covid-19, available to download here.

The main European measures so far

Since the outbreak of the pandemic, national governments have been at the frontline. However, they have been backed by European action on mainly three economic axes: (1) monetary and banking, (2) state aid and fiscal rules, and more recently, (3) funding. We present a brief overview of these three axes as of mid-May 2020 and underline the main difficulties that will appear down the road.

Since the beginning of the Covid-related economic crash, the ECB has reacted swiftly both in terms of monetary policy and as a bank supervisor, while banking regulations were also relaxed (see Annex 1).

The swift action on the monetary front was complemented with measures to incentivise banks to lend. Not only would the latter benefit from a negative refinancing cost, but they would also benefit from a more friendly provisioning framework for non-performing loans, and various capital buffers would also be relaxed to make room for these additional loans (see Annex 2).

Towards a European fiscal response, slowly

On the fiscal front, the European response started by easing the way for national policies rather than designing an EU-level response. Indeed, the Commission was fast to enact two important decisions:

- relax state aid rules, and

- activate the general escape clause in the Stability and Growth Pact.

These two measures have created leeway for immediate support at the level of member states. At the level of the EU and of the euro area, though, progress has been much slower. The debate has developed along several dimensions:

Conditionality

The role of conditionality is to ensure that the loans will be repaid, hence that the emergency assistance is distinct from a bailout. Partly, the reluctance to lend without conditionality may be related a wish of creditors want to have a say on the spending, a concern may seem legitimate in view of the political pressures governments face internally. But it is also informed by moral hazard concerns and by the history of a protracted and polarised debate in the wake of the last crisis. In other words, the internal political discourse in a number of countries is still replaying the last financial crisis rather than confronting the present one.

The internal political discourse in a number of countries is still replaying the last financial crisis rather than confronting the present one.

Loans versus grants (i.e. true fiscal spending)

According to the Treaty (Art. 310), the EU budget needs to be balanced on a yearly basis. Art. 122(2) nevertheless allows the EU to borrow in order to extend back-to-back loans to a member state in case of “natural disasters or exceptional occurrences beyond [its] control”. Beyond the legal discussion, there is a strong economic case for a mixture of loans and grants. In particular, when a sovereign or a corporate is already highly indebted, adding on further indebtedness can lead to long run problems of debt overhang.

While the SURE initiative relies on loans (see Box 3), the European Commission and the Franco-German agreement of 18 May 2020 envisage a large proportion of spending in the Recovery Fund. The Commission would borrow on markets but instead of lending the money to national governments, it would spend it on specific recovery programmes, as part an EU comprehensive recovery strategy within a temporarily increased EU budget.

European (EU Budget) versus joint and/or several borrowing (or ‘Coronabonds’)

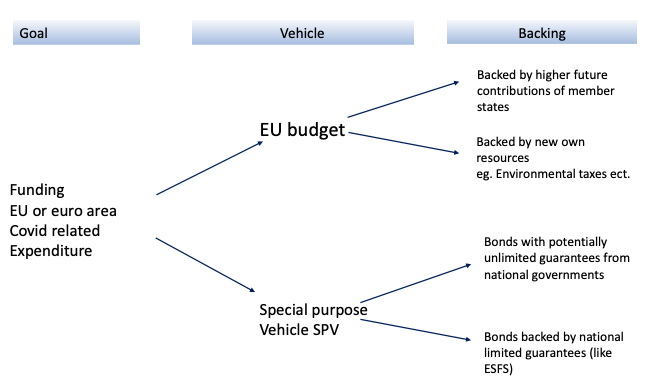

This is the area where the debate has been most difficult and divisive. In principle, it is in the self-interest of each member state that (1) the other member states have enough resources to fight the pandemic (including with costly lockdowns), and (2) the pandemic does not trigger a sovereign debt crisis. Hence, each government should be able to borrow at low interest rates over long maturities in order to minimise the cost of the debt and the rollover risk. Also, European-level commons should be funded at the supranational level and in common. A key advantage of supranational-level borrowing is that is alleviates the pressure on national debts. Also, it would allow to create potentially large volumes of ‘safe assets’ that would stabilise the banking sector and also make the asset purchasing programmes of ECB easier. However, the different proposals have different implications in terms of liability, as described in Figure 1.

Figure 1 Possible options for funding

One way to enable to European Commission to borrow on behalf of the EU is to back the issued bonds with future higher contributions to the EU budget by the member states. An alternative (or complement) would be to back the debt at least partially with new own resources, like ETS proceeds, carbon taxes or other levies.

Another route is through some kind of ad hoc special purpose vehicle (SPV). This in turn could have two variants. The first is one in which the SPV borrows with a joint and several guarantee from member states (Eurobonds or Coronabonds). Alternatively, the SPV could issue debt-backed limited (capped) guarantees of the member states (i.e. several, but not joint guarantees). This was the case of the European Financial Stability Facility (EFSF), a crisis resolution SPV created in 2010 to provide financial assistance to Ireland, Portugal and Greece.

Own resources

One key element of the equation in the post-crisis period will be the ability of the member states to raise taxes without blocking the recovery of the private sector. There are two ways to do this. The first is to look for a new, ‘own’ resource (Garicano 2020). A carbon resource (revenues from the ETS market, carbon taxes) would be especially suitable as it would align the incentives of the governments on the Green Deal master project. A second avenue, which should be thought of as a complement to the first, would be to accelerate the tax coordination projects at the EU level – corporate income tax, notably for digital activities; a new VAT regime; digitalisation of tax administrations, etc. (e.g. Bénassy-Quéré 2019) – in order to plug the various cross-border leaks that together amount to more than 1% of GDP, and possibly to enforce more progressive tax systems.

What is needed now: Repair, reboot, recover

During the first phase, the priority of governments was to avoid unnecessary suffering, the closure of firms and the loss of jobs. Governments’ and central banks’ actions were all about providing enough liquidity to households, firms and banks, and the guiding principle was “act fast and do whatever it takes” (Baldwin and Weder di Mauro 2020).

In the second phase of reopening of the economy, demand is still sluggish and some of the more long-term damage of this crisis starts to become more visible. Some firms are unable to repay the loans they received and insolvencies increase. Industrial restructuring plans start to be announced. The defining principle during this phase should be to repair corporate balance sheets and avoid the problems of a debt overhang, disincentives to invest and mass insolvencies. This suggests a different package of measures:

- Cleaning corporate balance sheets. This will involve moving from debt to equity or equity-like instruments. For the small and medium-sized firms, equity-like instruments would serve this purpose (Boot et al. 2020a, 2020b). A European equity fund should serve to level the playing field across countries (compensating for unequal capacities at the national level to provide generous funding). It could also top-up national schemes, with the national government taking the ‘first loss piece’. However, a number of principles should be observed. First, given the very large number of firms in the EU, the implementation of government intervention should be left to the national level, albeit with simple, transparent and comparable rules across the member states. Second, the design of government intervention should make sure that banks incorporate the social cost of bankruptcies in their decision-making. For instance, public creditors could accept higher haircuts than private ones in case the debts of a viable firm are restructured. Third, for large firms, given the externalities for the Single Market (competition, value chains), the Commission should take the lead to organize the restructuring in the most affected sectors (e.g. airlines). In case of temporary nationalisation, contingency plans should be made for subsequent privatisation.

- Encouraging labour reallocations. During the recovery phase, demand will stay depressed in some sectors (e.g. restaurants), whereas it may recover relatively quickly in some others (e.g. construction). Within each sector, the demand will also recover unevenly (e.g. more e-commerce and fewer physical shops). Hence, we cannot exclude labour shortages in some sectors or sub-sectors while unemployment would stay high in others. Today, it is impossible to assert whether these effects would be transitory or permanent. Hence, we should perhaps think in terms of short-term flexibility and in terms of option value. This will involve flexible arrangements such as ‘lending’ workers by one firm to another firm for a limited period of time, retraining the unemployed for new jobs, even if at the end they can recover a job in their initial occupation, and scaling-up on-the-job training of the new generations.

The pandemic may well have a long-lasting impact on the distribution of demand between consumption and investment. To the extent that collective preferences have shifted in favour of preserving the environment and investing in health protection, the new growth regime will rely on more public and private investment, and less consumption. The Recovery plan should accompany this structural shift through facilitating factor reallocations, supporting public investment, incentivising private investment and mobilising households’ savings.

Conclusion

This week the European Commission will present its EU Recovery plan, and the contours that are becoming visible look promising. If enacted as foreseen (€500 billion of spending along a few strategic priorities, backed by the EU budget with possible own resources), it would indeed constitute a quantum leap for EU-level fiscal policy action.

Fiscal policy starts when the budget can be in deficit in bad times and in surplus in good times. The de-correlation between national contributions (based on each country’s GDP and/or on own resources) and the allocation of spending (based on the needs) is not entirely new since it is at the core of structural funds. However, it will de facto entail one-off transfers from the least affected countries to the most affected ones. This will be a significant sign of European solidarity and unity.

References

Baldwin, R and B Weder di Mauro (eds) (2020), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes, a VoxEU.org eBook, CEPR Press.

Bénassy-Quéré, A and B Weder di Mauro (eds) (2020), Europe in the time of Covid-19, a VoxEU.org eBook, CEPR Press.

Boot, A, E Carletti, H H Kotz, J O Krahnen, L Pelizzon and M Subrahmanyam (2020a), “Coronavirus and financial stability 3.0: Try equity – risk sharing for companies, large and small,” VoxEU.org, 03 April.

Boot, A, E Carletti, H H Kotz, J O Krahnen, L Pelizzon and M Subrahmanyam (2020b), “Corona and Financial Stability 4.0: Implementing a European Pandemic Equity Fund”, VoxEU.org, 25 April.

Garicano, L (2020), “Towards a European Reconstruction Fund”, VoxEU.org, 5 May.

Annex 1: The main actions of monetary policy

Refinancing operations

- Targeted: TLTRO III: funding cost = deposit facility rate - 25 basis points.

- Non-targeted: PELRO (Pandemic Emergency Longer-term Refinancing Operations), seven operations starting in May 2020, fixed rates (25 bp below main refinancing operation rate), maturities up to the summer of 2021.

Collateral policy

- Expansion of accepted collateral (guaranteed loans to SMEs and self-employed) + freeze of eligibility as of 7 April 2020 even in case of subsequent downgrade (provided >BB); waiver for Greek bonds

- Reduced haircuts (e.g. from 35% to 22% for credit claims)

Asset purchases

- Renewed asset purchases programme (including public sector asset purchases): €20 billion per month + reinvestment of maturing bonds

- Additional €120 billion up to December 2020

- PEPP: € 750 billion; flexibility with respect to capital key and share in issuance

Annex 2: Measures for the banking sector

Accounting

- Flexibility in the application of the new accounting standards (IFRS9) concerning expected credit losses (provisioning) when increased probability of default is expected to be temporary; discarding moratoria on loan repayments if they do not change the economic value of the loan; use of transitional arrangements in the calculation of CET1.

- Subtract moratoria in the calculation of non-performing loans (90 days past due) while still assessing credit quality

Prudential regulations

- Relaxation of capital requirements: capital conservation buffer, counter-cyclical capital buffer; possible use of Tier-2 capital to meet Tier-1 requirements.

- Relaxation of liquidity requirements (liquidity coverage ratio)

- Postponement of the implementation of the leverage ratio by one year

- Relaxation of concentration limits for bond holdings

- Relaxation of supervisory burden

Annex 3: Fiscal measures at the European level

Fiscal and state aid rules

- Suspension of the Stability and Growth Pact rules by recognising that the conditions for the general escape clause in the EU fiscal framework, namely a severe economic downturn in the euro area or the Union as a whole, where fulfilled (23 March, Eurogroup)

- Relaxation of state aid rules. A temporary framework allows for direct grants or tax advantages, subsidised state guarantees on bank loans, loans at subsidised interest rates, state-sponsored export credit insurance, subordinated debt and equity injections. These various instruments are capped and firms need to be viable as of end-2019.

Protecting firms: Pan-European guarantee (EIB)

- €25 billion of national guarantees; increasing by €200 billion the EIB’s capacity to extend credit guarantees to commercial banks, national promotional institutions and national guarantee schemes; counter-guarantees; purchases of asset-backed securities from banks and some venture debt.

Protecting jobs (SURE)

- Loans to national governments in order to finance surges in expenditures related to short time work (kurtsarbeit) and support to independent workers

- Commission borrows up to €100 billion backed by EU budget headwinds + €25 billion of national guarantees, maximum repayments of €10 billion per year, to be discontinued after Covid crisis, Art. 122(2) of the Treaty (Eurogroup, 15 May 2020).

Protecting sovereigns: Pandemic crisis support (ESM, euro area countries only)

- Loans to national governments in order to pay for Covid’s direct and indirect healthcare and prevention costs, no conditionality, up to 2% of GDP, maximum average maturity of ten years, discontinued after December 2022 (Eurogroup, 9 May 2020).

Restarting the EU economy (Recovery Fund)

- Loans to national governments, direct spending on programmes and capitalisation of an equity fund, possibly totalling €500 billion and backed by future surcharges on member states’ contributions to the EU budget and/or own resources. To be discontinued after the funds are repaid, possibly over a long period.