Articles from 29 October - 4 November

General Financial Policy

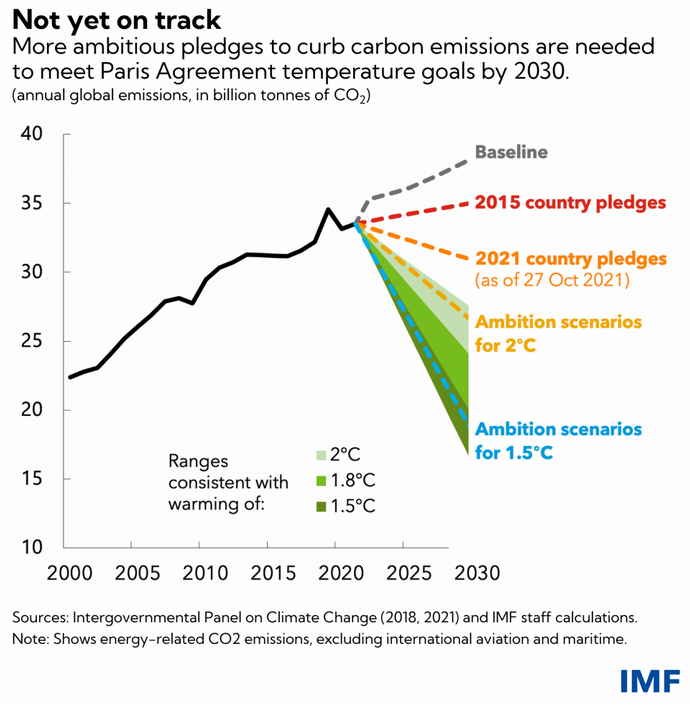

IMF's Georgieva: Not Yet on Track: Climate Threat Demands More Ambitious Global Action : As world leaders gather in Glasgow for COP26, a new IMF Staff Climate Note shows unchanged global policies will leave 2030 carbon emissions far higher than needed to “keep 1.5 alive.”

The ECB pledge on climate change action : On the occasion of the 2021 United Nations Climate Change Conference (COP 26),the ECB pledges to contribute, within its field of responsibility, to decisive action bypolicymakers to implement the Paris Agreement and mitigate the consequences ofclimate change.

Bruegel: Is the ECB right to take on climate change? : The real issue here is not that the ECB takes a very sizeable risk by pursuing climate objectives but rather, that it cannot afford not to. And by doing so, it helps establish just how urgent climate change is.

Banking Union

ESBG: The EU Commission’s proposed ‘single-stack’ approach for Basel III finalisation would harm European banks : The European Savings and Retail Banking Group (ESBG) calls on the European Parliament and the Council of the EU to reconsider the output floor implementation on a ‘single-stack’ approach included in the European Commission’s proposal for the finalisation of the Basel III standards in the EU, announced today

Capital Markets Union

BIS: Non-bank financial intermediaries and financial stability : NBFIs' prominent role has brought benefits by diversifying funding sources, but it has also exacerbated some liquidity imbalances that can, in extreme cases, endanger financial stability.

Environmental, Social, Governance (ESG)

IFRS Foundation announces International Sustainability Standards Board, consolidation with CDSB and VRF, and publication of prototype disclo : IFRS Foundation Trustees (Trustees) announce three significant developments to provide the global financial markets with high-quality disclosures on climate and other sustainability issues:

G20 supports IFRS Foundation sustainable standard-setting - and much else : We welcome the agreement by Finance Ministers and Central Bank Governors to coordinate their efforts to tackle global challenges such as climate change and environmental protection, and to promote transitions towards green, more prosperous and inclusive economies

Basel Committee supports the establishment of the International Sustainability Standards Board : The Committee supports the IFRS Foundation's proposed approach to developing globally consistent disclosures by working with relevant standard setters and building on existing initiatives and frameworks, including the Task Force on Climate-related Financial Disclosures (TCFD).

IFRS Foundation ´s International Sustainability Standards Board on the Right Track, Says IOSCO : If the ISSB’s future standard meets IOSCO’s expectations, our endorsement willsupport all our 130 members in considering ways they might adopt, apply or be informed by thestandard.

UNEP FI: Net-Zero Asset Owner Alliance responds to reclaim finance report : Asset owners themselves must raise ambition to achieve robust interim emission targets for which they are accountable.

UNEP FI: Net-Zero Banking Alliance reaches milestone with over 90 banks committed : Leading the 1.5 Degree Journey: Aligning the Banking Sector. This is also the drive behind the industry-led, UN-convened Net-Zero Banking Alliance, the banking element of the Glasgow Financial Alliance for Net Zero

ESMA: European enforcers target COVID-19 and climate-related disclosures : This year’s priorities cover the impact of COVID-19 and climate-related matters,provide guidance on the measurement of expected credit losses and highlight disclosureobligations pursuant to Article 8 of the Taxonomy Regulation.

EPC: The European Green Deal: How to turn ambition into action : The EU can do this by acting as a rule-maker and enforcer; an economic powerhouse; a source of significant funding within the EU and beyond, a mobiliser for private financing; a convening power; an innovator and developer of new solutions; as a standard-setter; as a major producer and consumer.

CEPS: COP26 in Glasgow : Don’t give up on Paris – the climate ambition ratchet may be working

ICMA: EU Taxonomy Regulation Article 8 and unintended negative consequences for the development of the green bond market : ICMA is recommending either the urgent review of the exclusion of green and sustainability bonds of central governments, central banks and supranational issuers from the calculation of the GIR and GAR in the draft Delegated Act supplementing Article 8 of the Taxonomy Regulation.

Setting regulatory and supervisory expectations for asset managers is fundamental to address greenwashing concerns, says IOSCO : There have been challenges associated with the growth of ESG investing and sustainability-related products in recent years, including a greater need for consistent, comparable, anddecision-useful information and the risk of greenwashing.

EBA reaffirms its commitment to support green finance in view of the UN Climate Change Conference : EBA published its environmental statement in the context of COP26, highlighting its efforts to update and enhance the entire supervisory and prudential regulatory framework in the environmental, social and governance (ESG) domain.

Protecting Customers

ESMA/EBA: GUIDELINES ON THE ASSESSMENT OF THE SUITABILITY OF MEMBERS OF THE MANAGEMENT BODY AND KEY FUNCTION HOLDERS 1 : These Guidelines set out appropriate supervisory practices within the European System of Financial Supervision and regarding how Union law should be applied.

Economic Policies Impacting EU Finance

OECD Secretary-General Mathias Cormann welcomes outcome of the G20 Leaders Summit : At their summit in Rome this weekend, G20 leaders called on the OECD/G20 Inclusive Framework on BEPS to develop the model rules and multilateral instruments swiftly, to ensure they come into effect globally in 2023.

Brexit and the City

Federal Trust - Graham Bishop: Is the City of London’s tumbril drawing closer to the scaffold? : Should the EU sub-contract vital parts of its financial infrastructure to a “third country”? Is that third country a reliable partner who can be trusted - in a moment of crisis – to act in the best interests of the EU, especially if there may be large costs involved? Many would say No.

City of London Corporation welcomes UK plans to become the world’s first net zero aligned financial centre : The Chancellor Rishi Sunak made a speech this morning [3 November] at COP26 Finance Day in Glasgow, where he announced plans for the UK to be the world’s first net zero aligned financial centre.

Sewing: ISSB in Frankfurt a major success : Christian Sewing, President of the Association of German Banks, on the decision of the IFRS Foundation to base the International Sustainability Standards Board (ISSB) in Frankfurt am Main, Germany: