|

|

Government bonds are central to the broader landscape of financial markets. As high-quality liquid assets, they are an essential component in investor portfolios, and their rates serve as a benchmark for the pricing of other financial assets. The smooth functioning of government bond markets is therefore essential for maintaining a healthy and efficient market environment.

In recent years, euro area government bond (EGB) markets have witnessed a surge in the activity of hedge funds. Hedge funds are specialised investment vehicles that deploy complex strategies, including short-selling, leverage or derivatives, to improve their performance. They thrive in the context of high volatility, face fewer regulatory constraints than banks and are more flexible in adjusting their portfolios than traditional investment funds.

In this blog post, we explore the implications of this market transformation, examining how hedge funds influence the absorption and functioning of euro area bond and repo markets.

The shifting macroeconomic landscape since the COVID-19 pandemic, along with significant monetary policy adjustments, has coincided with increased market volatility. Moreover, regulatory changes following the global financial crisis have imposed additional costs associated with balance sheet extensions for dealer banks, affecting their ability to intermediate in government bond markets.[2]

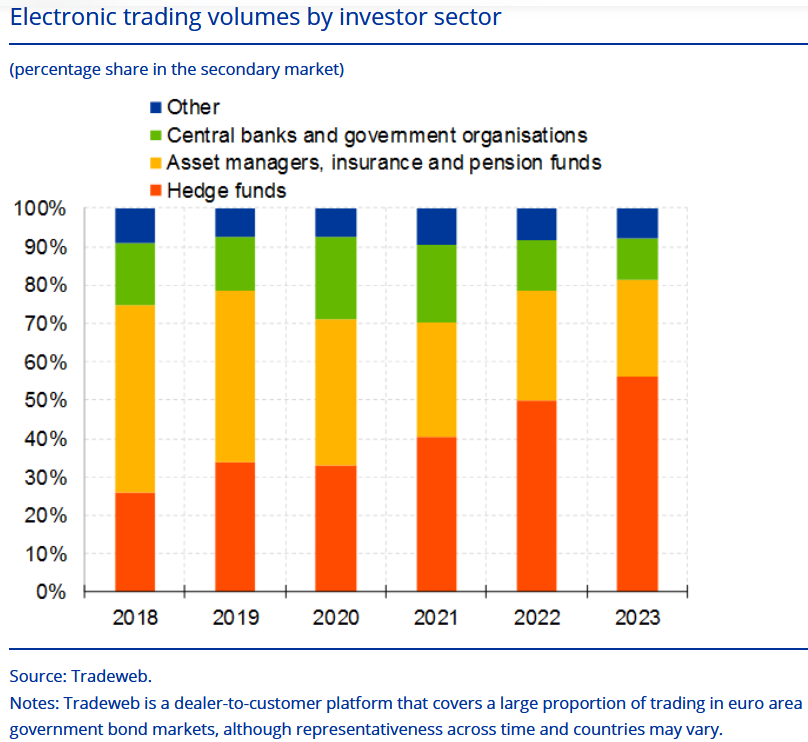

In this context, foreign investors have contributed significantly to absorbing the net supply of government bonds across the euro area, particularly since the onset of the Eurosystem’s balance sheet reduction. Among foreign investors, hedge funds have assumed a prominent role in EGB markets. Data from one leading electronic platform for the trading of bonds show that hedge funds roughly doubled their volumes of EGB transactions in secondary markets from 2018 to 2023 (Chart 1). According to this data, hedge fund activity represented 56% of volumes in the secondary market in 2023, up from 26% in 2018. This trend appears to have coincided with a migration of experienced staff from banks and asset managers to hedge funds.[3]

Although hedge funds may not hold government bonds for extended periods, their substantial trading volumes and their strong participation in public debt auctions indirectly support bond absorption. According to an ad-hoc survey of large primary dealers carried out by the ECB Bond Market Contact Group, hedge funds now represent over 50% of the total requests received by dealer banks around public debt auctions in Germany, France, Italy and Spain. Hedge funds thereby contribute to the success of government bond auctions both by placing orders directly with dealer banks and by facilitating the offloading of dealers’ allocations after the auction.