While many economists are in favour of carbon taxation, the public often opposes this climate policy. This column uses data from a survey of 3,000 people in France to show that rejection of a carbon tax is driven by pessimistic beliefs regarding the properties of the tax.

Even when revenues from the tax are

redistributed to households so as to make the policy progressive, most

people think that they and low-income households would lose out, and

that the policy would not be effective at reducing emissions. Public

investments and standards could help foster support for an ambitious

climate policy.

While 5,000 economists called for the rapid development of carbon taxation in the US and in Europe,1 the

public often opposes this climate policy (Carattini et al 2018, Klenert

and Hepburn 2018). In France, the government abandoned its plan for an

ambitious carbon tax trajectory following the protests of the ‘yellow

vests’.2

Why do citizens

often oppose carbon taxation? Two common explanations are that citizens

refuse to bear the full costs of climate change mitigation for lack of

altruism, or that they disagree with the way those costs are

distributed. In a new paper (Douenne and Fabre 2022), we argue that a

third mechanism may come into play — even when people are expected to

benefit from carbon taxation, pessimistic beliefs about the effect of

the policy could lead them to oppose it. It is not intuitive that people

could benefit from carbon taxation. Actually, carbon taxation alone is

generally regressive because poorer households spend on average a larger

share of their income on polluting goods. Yet, since they spend less on

these goods than richer households in absolute terms, it is sufficient

to transfer the proceeds of the tax as a uniform transfer (a policy

known as a carbon tax and dividend) to design a progressive policy and

make a majority of people better-off (Pizer and Sexton 2019, Douenne

2020, Paoli and van der Ploeg 2021).

Pessimistic beliefs and public support for carbon taxation

We assess attitudes

towards a carbon tax and dividend in France during the yellow vests

movement. We created a survey administered over 3,000 respondents

representative of the French population in February/March 2019. We

presented to respondents a budget-neutral €50/tCO2 carbon tax

and dividend policy, with information on the effect on energy prices

(e.g. +€0.11 per litre of gasoline) and the transfer that each household

would receive (€110/year for each adult). We find that people largely

reject this proposal — only 10% of our survey respondents approve, while

70% do not accept the reform. This level of rejection is very high

compared to what has been measured before or after the yellow vests

movement, where about half of the population is found to accept an

unspecified increase in the carbon tax (ADEME 2020). Thus, a first

insight from our survey is that public opinion can be very volatile and

strongly reacts to contemporary events.

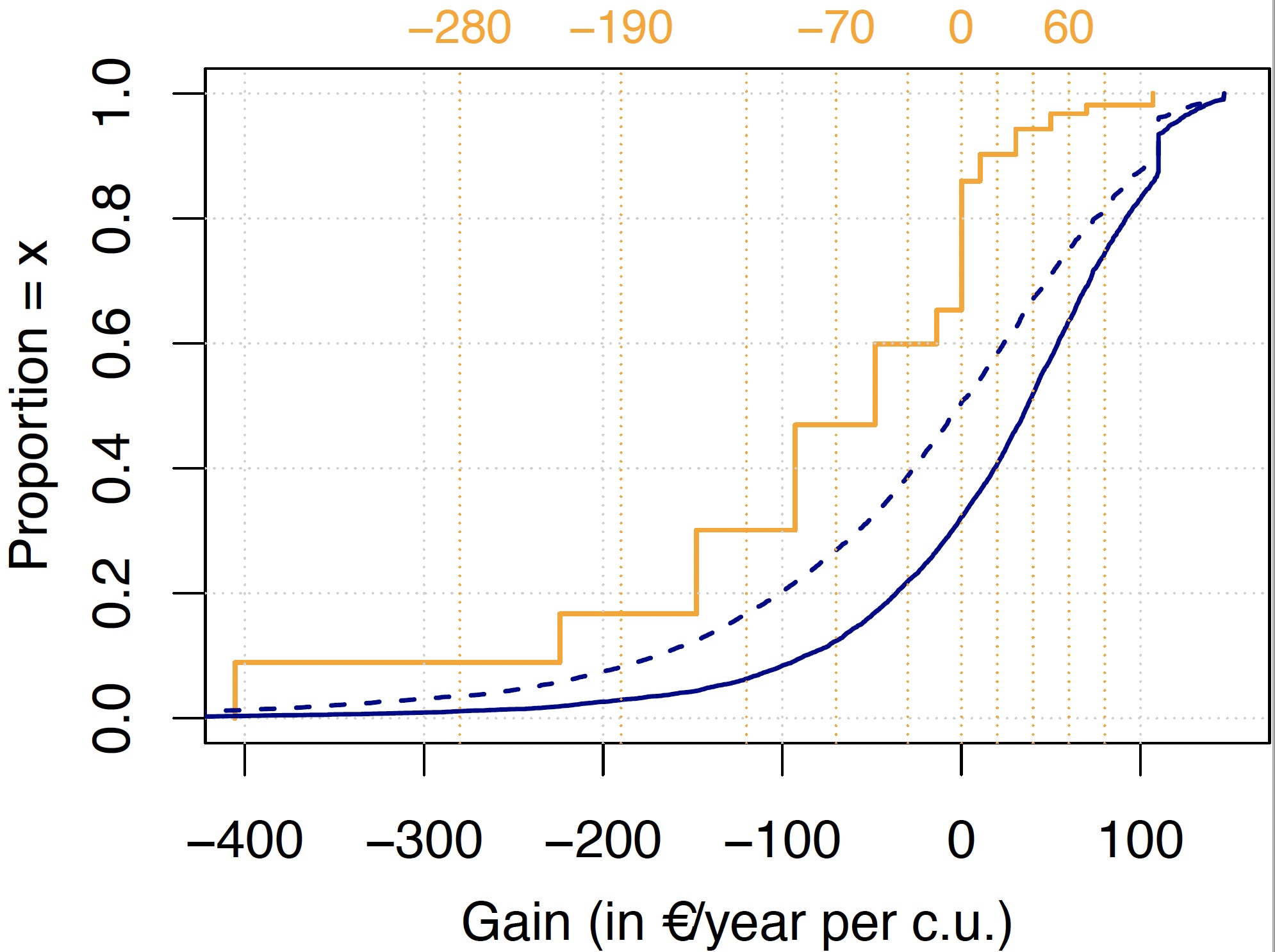

Figure 1 CDF of objective (dark blue) versus subjective (orange) net gains from our tax and dividend

Note:

Dashed blue lines represent distributions of objective gains in the

extreme case of totally inelastic expenditures. Vertical dotted orange

lines show the limits of intervals answers of subjective gains.

We then show that

people hold pessimistic beliefs about the policy. Using household budget

survey data, we estimate that 70% of households would benefit

financially from the policy (see the solid blue line in Figure 1). In

our own survey experiment, we ask respondents to estimate their expected

gain or loss from the reform (we proceed step by step, asking

separately for the impact on their heating and transport expenditures).

Only 14% think that their household would benefit from the reform. This

pessimism cannot be explained by an ignorance of price elasticities, as

respondents correctly estimate them in another question, and the gap

between perceived and actual net gains would still be too large if

respondents assumed that their expenditures were inelastic. Similarly,

respondents are pessimistic about the distributional and environmental

effects of the policy. Only 20% believe that the policy would benefit

poorer households and 17% think that the policy would be effective in

reducing polluting and fighting climate change.

We also find that

the more people are opposed to the policy, the more pessimistic they

are, and that the causality between beliefs and opposition runs both

ways. On the one hand, when provided with new information about the

policy, people discard positive news but correctly process negative

ones. This phenomenon is stronger for people who initially oppose the

policy or who feel close to the yellow vests, which is consistent with

the endogenous formation of beliefs through motivated reasoning. In

other words, the less people like the policy, the less likely they are

to assimilate positive information about it. On the other hand, our

survey design enables us to show that beliefs also causally determine

support for the policy. When convinced that they would gain financially,

people’s likelihood of accepting the policy increases by 50 percentage

points. Similarly, the likelihood of supporting it is 40 percentage

points higher when people are convinced that the policy would

effectively reduce emissions.

Vox

© VoxEU.org

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article