Europe's ethical investors may soften their attitude toward nuclear power after the carbon-free technology won EU recognition as a sustainable activity.

Nuclear will join the EU's green taxonomy next

year, potentially easing investor concerns about whether it should be

considered environmentally friendly. The move could in turn open new

funding sources for European nuclear operators, such as Electricité de

France SA, or EDF, and Fortum Oyj, as the industry faces up to €550

billion of investment needs through 2050, based on EU forecasts.

"The perception is shifting" among environmental,

social and governance investors, said Marina Petroleka, global head of

ESG research at Sustainable Fitch. "Suddenly nuclear is back in the

conversation."

The new green status adds to growing momentum for

the power source in Europe as technology developments and greater

appreciation for nuclear's ability to consistently supply carbon-free

power increasingly outweigh traditional worries about radioactive waste

and safety levels. The conflict in Ukraine may further accelerate the

trend by heightening concerns about Europe's reliance on Russian gas.

Paring this dependence will likely require "a

comprehensive energy mix," said Guillaume Mascotto, head of ESG strategy

at Jennison Associates, an investment company. That includes prolonging

the life of nuclear plants, as well as using renewables and LNG,

Mascotto said.

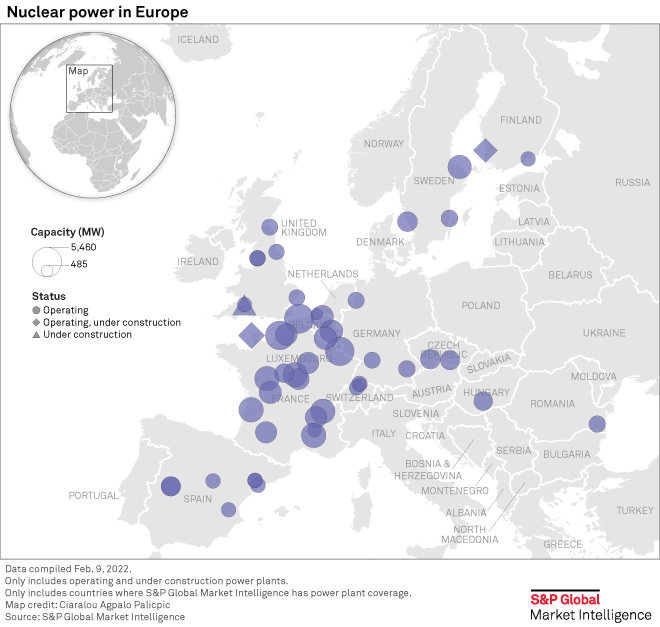

In a potential first sign of this trend, Fortum

said March 3 it planned to extend the lifetime of two units of its

Loviisa nuclear power plant in Finland to 2050.

Changing investor attitudes

The EU's taxonomy is "clearly setting the

expectations and setting a guide," said Kenneth Lamont, a senior

research analyst at Morningstar. It will help establish the parameters

for nuclear investments and could boost public confidence in the

technology in the longer term, Lamont said.

The green finance rulebook may help ease investor

concerns about nuclear because it sets out strict safety and

environmental criteria that must be met for a project to be labeled

green, Goldman Sachs analysts said in a January note.

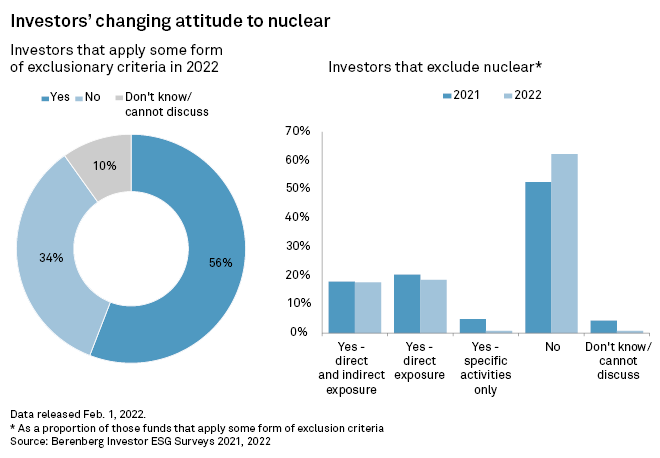

A shift in investor attitude is already underway,

with only 37% of funds with exclusions now barring nuclear assets,

according to a Berenberg ESG survey of more than 200 fund managers in

Europe and North America. That is down from 43% in a similar survey a

year earlier, the investment bank said in a Feb. 1 note.

Nuclear's inclusion in the green taxonomy could

further boost acceptance, providing a spur to shares of EDF and Fortum,

which are both involved in constructing new projects, Berenberg said.

The investment bank also highlighted Enel SpA, Iberdrola SA and E.ON SE, which have direct or indirect exposure to existing plants scheduled for closure, as potential winners from the change.

Admission to the EU taxonomy could let European

nuclear developers sell green bonds to help fund new plants, which was

previously unheard of in the region, said Petroleka.

That would potentially cut borrowing costs for

huge spending programs due to investor demand for ESG assets. Canadian

generator Bruce Power Inc., which sold what it said was the world's

first green bond for nuclear power in November 2021, estimated that the

bond carried a 3-basis-point "greenium," reflecting the funding cost

advantage associated with a green label. The C$500 million issue was

5.6x oversubscribed.

The Bruce Power bond has spurred interest in green

finance for nuclear and the taxonomy will likely encourage investors

further, said Christa Clapp, managing partner of Cicero Shades of Green.

The Norwegian green-bond rating provider endorsed the Bruce Power

security.

Easing capital access

A more open-minded investor attitude in light of

the taxonomy inclusion will help European nuclear companies including

EDF, said Antonio Totaro, deputy head of Europe, the Middle East and

Africa utilities and transport at Fitch Ratings.

EDF is funding U.K. plant Hinkley Point C and

French reactor Flamanville 3 through its own balance sheet for a total

of about €40 billion, Totaro said. But for new plants, including the

proposed Sizewell C plant in the U.K., it envisages going to the market

for a large part of the funding, which may be supported by the taxonomy,

he said.

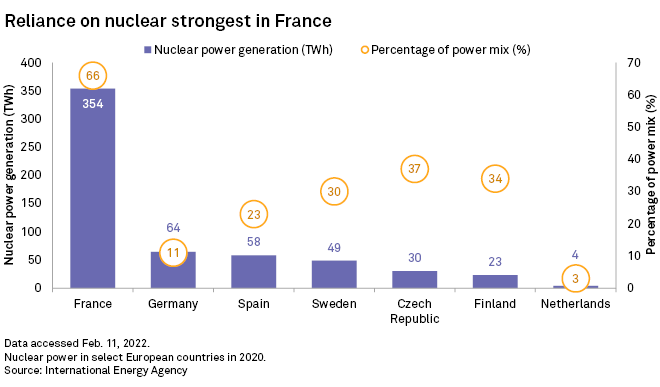

The French government, the majority shareholder of

EDF, could also issue sovereign green bonds for nuclear power,

according to Thomas Gillet, associate director for sovereign and public

sector ratings at Scope Ratings. The addition of nuclear to the EU

taxonomy is credit positive for France, Europe's biggest user of nuclear

power, Gillet said in a January note.

Companies developing new technology for nuclear

will likely also be placed to attract more ESG-labeled investments in

the future. The development of smaller, flexible reactors that generate

considerably less waste would be an "interesting perspective" for

investors such as Pension Denmark, said Jan Kæraa Rasmussen, its head of

ESG. The Danish pension fund, which manages €40 billion in assets, may

start to invest in nuclear once the new technology becomes scalable, he

said.

The French treasury department declined to say

whether it would consider offering green bonds to support nuclear

generation. Its current green-finance framework does not cover the

technology. EDF declined to comment on the taxonomy.

Fortum said it welcomes nuclear's addition to the

taxonomy as a "crucial step toward European energy transition." Nuclear

can help mitigate climate change because it provides baseload low-carbon

power not subject to volatility like wind and solar.

Risks remain

Still, not all investors will start to accept

nuclear just because it is on an EU list. The bloc's own lending arm,

the European Investment Bank, for instance, has already said that it has

no intention of financing nuclear.

Many green funds will likely stay away too, said

Isobel Edwards, investment analyst for green bonds at NN Investment

Partners. "We already have policies, which we don't change based off the

EU announcements," she said.

Investors are in particular concerned with

reputational risk and possible accusations of "greenwashing" from

environmental campaigners.

Opposition to nuclear remains strong in countries

such as Germany, Austria and Luxembourg, which all opposed adding

nuclear to the taxonomy. Germany is shutting its last reactors at the

end of this year. Some energy experts and environmental groups are also

against the change.

This may put investments at risk as opponents will

likely seek to challenge and sue new projects, said Alain Vallée,

president at French consultancy NucAdvisor, who spent three decades at

French nuclear giant Framatome. "Having nuclear included inside the

taxonomy will not stop the fight of several countries against nuclear

energy," Vallée said.

For now, the opposition is unlikely to have the

required numbers to prevent member states and the European Parliament

from signing off on nuclear's addition to the taxonomy, according to

Berenberg.

Financial concerns may also deter investors from

putting money into nuclear. Plants have vast up-front costs, and there

is a long wait for profits due to lengthy development and construction

times, particularly in comparison to renewables. Recent new-builds,

including the Finland's Olkiluoto nuclear plant, France's Flamanville 3

and the U.K.'s Hinkley Point C, all suffered from huge delays and cost

overruns.

Such issues further complicate both efforts to

raise investment for nuclear and policy makers' reliance on the

technology to meet environmental goals. The European sector will need to

draw €500 billion of investments into new-generation power stations by

2050 and a further €50 billion into existing plants to achieve the EU's

net-zero objective, European Commissioner Thierry Breton said in

January.

Still, nuclear's entrance into the EU taxonomy

should provide some help by at least opening the door to funding from

the ESG sector.

The change will allow "more nuanced views" of

nuclear, analysts at Goldman Sachs said in the January note. It could

mark the "beginning of a shift away from traditional hardline investment

exclusions."

S&P

© S&P - Standard and Poor

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article