Two underlying challenges; Little can be expected from market liberalisation; Rule-making is the key area of “ambition”; Area of ambition 1: Enhancing investmentArea of ambition 2: Promoting e-commerce and digital tradeWhat to do with unfinished business?

- There are two significant challenges underlying the Japan-UK FTA negotiation: the EU-UK FTA and the timeframe

- Better market access than the EU-Japan EPA provides cannot be

expected from this negotiation except for some outstanding issues. This

is not only because of the extraordinarily short negotiating timeframe,

but because of other multi-layered reasons. The UK is already enjoying a

high degree of market liberalisation in the EU-Japan EPA. Also, the

UK’s bargaining power is limited due to its market size relative to

Japan’s. What is more, MFN provisions in the EU-Japan EPA prevent Japan

from conceding higher levels of liberalisation to the UK than to the EU

both in goods and services.

- Accordingly, rule-making will play a pivotal role if the parties are

to achieve a “EU-Japan EPA-plus” agreement. Given the unprecedentedly

short negotiating timeframe, the scope of “ambition” has to be narrowed.

- For the UK, maintaining current Japanese investment and attracting

future investment is vital for job creation, innovation and regional

inclusiveness. It should be a UK priority to design the Japan-UK FTA so

that it can stimulate investment, creating a comprehensive investment

chapter which covers investment liberalisation, protection and dispute

settlement..

- Creating a comprehensive chapter on e-commerce and digital trade should be another highlight of the Agreement.

Introduction

The Japanese and UK governments launched a bilateral trade negotiation on 9th June 2020 to create an “ambitious, high standard and mutually beneficial” Free Trade Agreement (FTA) based on the EU-Japan EPA.[2]

The parties are aiming to conclude the FTA by the end of the

post-Brexit transition period on 31 December and make a swift transition

from the EU-Japan Economic Partnership Agreement (EPA) on 1st January 2021 so as not to interrupt business.

Although the political incentive to achieve the FTA is mounting on

both sides, there is a lack of in-depth multi-disciplinary analysis

which captures the whole picture of the negotiations. This paper aims to

examine the issues we should consider when assessing its value. First, I

argue that there are two key underlying challenges for this

negotiation. Then I discuss what should be prioritised to make the

Japan-UK FTA ambitious, taking into account the unprecedented short

negotiating timeframe. Lastly, I address a few other outstanding issues

and propose a possible mechanism to cope with unfinished business in

order to make the agreement truly valuable from the long-term point of

view.

Two underlying challenges

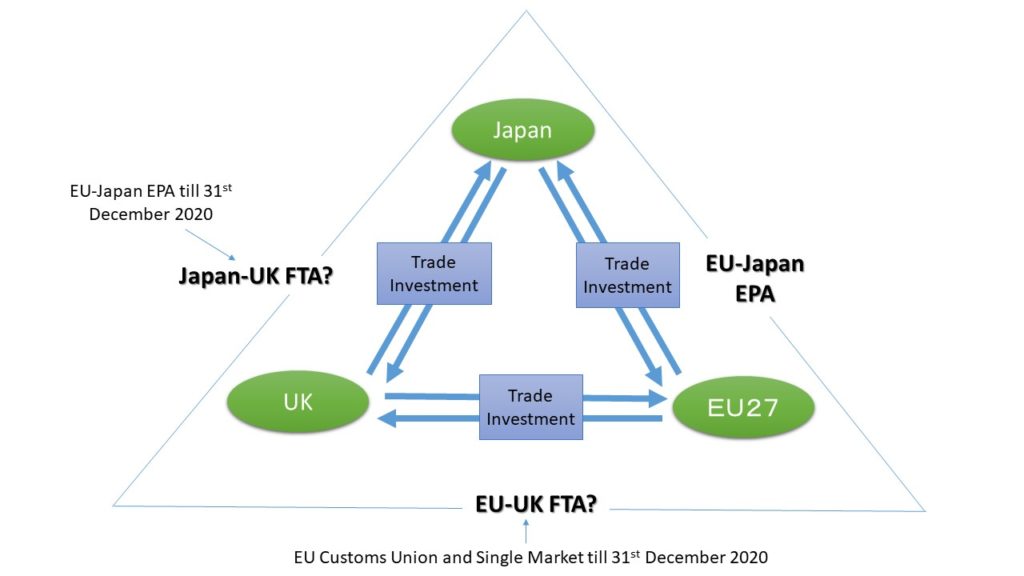

There are two significant challenges underlying the Japan-UK FTA

negotiation. The first is that the Japan-UK FTA on its own cannot

reflect the EU-Japan-UK trilateral relationship. Although the Japan-UK

FTA negotiation is a completely independent bilateral negotiation from

the EU-UK future relations, the EU-UK FTA does matter for business

because the Japan-UK trade and investment relationship constitutes one

side of the EU-Japan-UK trilateral relationship. (Figure 1).

Figure 1: EU-Japan-UK trilateral relationship

This trilateral trade and investment relationship is the product of

Japanese and UK firms’ engagement in Global Value Chains (GVCs) and

supply chains in Europe. For Japanese business, this trilateral

relationship is particularly important. As widely known, since the

1980s, Japanese firms have established a business model in Europe of

using the UK as a hub for business in Europe or a gateway to the EU

market. The precondition of this business model was that the UK is an EU

member state. In other words, free movement of goods, services, people

and capital as a part of the EU Customs Union and the Single Market were

taken as granted.

The end of frictionless trade between the EU and the UK after the

Post-Brexit transition period directly impacts the current Japanese

business model. According to a survey, the top concern of Japanese

companies doing business in the UK and the EU is the EU-UK future

relationship. Notably, border frictions created by new border controls

and customs procedures; tariff rates; and ending the free movement of

people are listed as the factors that impact most heavily on Japanese

business in Europe, especially manufacturers. Given that these factors

threaten their day-to-day business, their interests in the Japan-UK FTA

are overshadowed.[3]

Of course, British firms also have far more at stake in the EU-UK FTA

than the Japan-UK FTA and ration their attention accordingly.

The second underlying challenge is to strike a balance between

“continuity” and “ambition”. The Japanese government expressed the

necessity to complete the bilateral negotiations by the end of July, in

order to fit the outcome into its domestic legislative process. This

means a negotiation timeframe is less than two months since the

negotiation has launched on 9th June. Even though the negotiation is based on the EU-Japan EPA, the negotiating timeframe is unprecedentedly short.

Both governments are currently negotiating a deal that prioritises

“continuity” because high-level political pressures for achieving

“continuity” are mounting. The UK government has recently conceded that a

UK-US FTA will not be concluded before the US Presidential election

this autumn despite the strong desire to make it a central in the

“Global Britain” agenda. [4]

Accordingly, striking a trade deal with Japan, the world’s

third-largest economy, is expected to be the first major FTA deal for

Post-Brexit Britain. For the Japanese government, there is strong

pressure from Japanese business to achieve a smooth policy transition

from the EU-Japan EPA to the Japan-UK FTA on 1st January 2021 in order to avoid business destructions.

On the other hand, Japan is wishing to pursue an “ambitious” FTA with

the UK. It was Japan that rejected rolling over the EU-Japan EPA. There

were two reasons for Japan’s rejection.[5]

One reason is that Japan wanted to achieve a higher level of

liberalisation and rule-making in the areas where Japan could not

reflect its interests when it negotiated the EPA with the EU. This

unfinished business for Japan includes immediate elimination of auto

tariffs; an innovative chapter on digital economy; and a comprehensive

investment chapter encompassing liberalisation, protection and dispute

settlement. The second reason was the domestic legislative procedure.

Even though Japan had concluded a “continuity agreement” with the UK

which completely replicated the EU-Japan EPA, the Agreement was regarded

as a new FTA. This means that it requires a formal approval procedure

to pass the Diet (Parliament) of Japan, which is always time-consuming

and not a straight-forward process. Once the continuity agreement is

approved, it would become almost impossible to renegotiate.

From the UK’s point of view, a great advantage of making a new FTA

with Japan is that it can directly reflect its economic interests. When

the EU-Japan EPA was negotiated, the UK interests were marginalised and

focus was given more to exports of agri-food products and processed

agricultural products, non-tariff barriers on goods (i.e. TBT, SPS) and

trade and sustainable issues. By creating a new FTA based on the

EU-Japan EPA, the UK could focus on its economic interests, such as

services trade and digital trade.

Little can be expected from market liberalisation

Then, in what way could both governments strike a balance between

“continuity” and the scope and level of “ambitions”? Trade negotiations

can be categorised into market access negotiations and rule-making. In

the case of the Japan-UK FTA, market liberalisation in goods and

services cannot be expected except for some outstanding issues, such as

accelerating the schedule of tariff eliminations and inclusion of

sectors currently exempted from the EPA.[6]

For example, Japan shows strong interest in the UK’s immediate

elimination of the auto tariffs (the current MFN tariff is 10%), which

are scheduled to be eliminated in eight years in the EU’s commitments.

In services, including audiovisual services, which is exempted from the

EU-Japan EPA, due to EU’s principle on protecting the diversity of

cultural expression, would be of mutual interest to Japan and the UK.

Full paper

more at UKTPO

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article