Prominent voices propose financing the European Recovery Fund using joint perpetual debt. This column argues that there are gains from using European borrowing and lending as two separate policy levers. In a world of ultra-accommodative monetary policy, financing the Fund issuing debt at shorter maturities and passing those low interest rates onto member states through loans with low margin and with very long maturities is financially cheaper. Supporting the recovery through this maturity transformation would reinforce debt sustainability across the EU.

A number of prominent voices have put forward the idea of funding a large investment package (€1.5-2 trillion) to support the EU recovery from Covid-19 by issuing EU perpetual bonds (consols). Such a joint recovery plan is seen as vital for the stability of the EU. One argument in favour of using consols is that committing to joint perpetual debt delivers a high degree of mutualisation.

The idea has recently been floated by Garicano (2020), Giavazzi and Tabellini (2020), Verhofstadt and Garicano (2020) and the Spanish Government (EU Council 23 April 2020) to name a few recent ones (see the discussion in Baldwin and Weder di Mauro 2020). Soros (2020) also backed the idea, stressing that consols were used in the past by both the UK and US. Prior to COVID-19, in a somewhat different context, Paris and Wyplosz (2014) proposed a “plan PADRE” to deal with high public debts in the euro area, essentially by swapping existing debt instruments into zero-coupon consols held by the ECB.

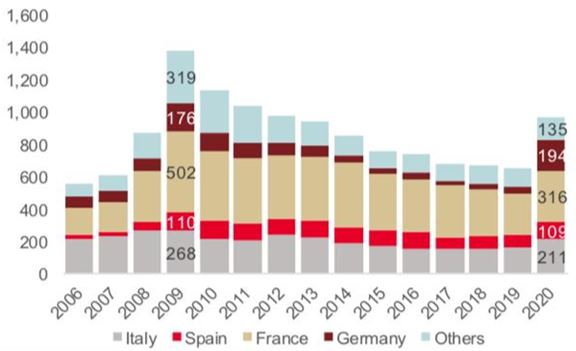

We share the objectives motivating these proposals: lending long-maturity to states will be crucial to create space for effective recovery policies. However, we want to call attention to one fact. By borrowing through consols, the EU would stand in sharp contrast with the recent practice of countries like the US or Germany that, when facing unexpectedly large financing needs, have relied heavily on the shorter part of the curve. Figure 1 shows that, both in 2009 and today, Germany reacted to tensions by significantly increasing short term issuances. How come the Debt Management Offices (DMOs) in Germany and other European countries prefer not to issue consols or very long-term debt? What are they (we) missing?

Figure 1 Yearly bill supply for main euro area issuers* (billion euros)

Source: Individual insurers and SG Cross Asset Research/Rates

Note: *2020 assumption based on 2019 plus projected increase in net bill supply. Others includes Finland, Ireland, Portugal, Belgium and the Netherlands.

What is a consol? A historical perspective

Consols are the longest-term debt possible. In fact, the holder of a consol does not get its principal back, but is indefinitely entitled to an annual fixed coupon.

Perpetual debt can be dated back to the 8th century (Mihm 2019). In order to encourage the bequest of land to monasteries, the Catholic Church promised donors an annual sum reflecting the land’s value. This annuity would often run in perpetuity. In the middle-age, the church’s fight against usury created an unexpected new risk for lenders. When confronted with large liability payments, debtors could charge creditors with usury and walk away from their debts. By ruling out large principal repayments, perpetuities provided a way to contain this risk.

National governments also experimented with perpetuities. By the 16th century, sovereign consols were traded in secondary markets. In 1752, the UK converted its debt into perpetual bonds. Alexander Hamilton did the same when he consolidated the debts of the US.

Consols fell from favour during the 19th century. The US replaced them with fixed-maturity obligations during the 1830s. The UK redeemed most of its perpetuities in 1888. The last UK perpetual bonds were redeemed in 2015.

Is issuing consols a cost-effective option?

There is one essential problem with financing the current crisis issuing consols. In a world of ultra-accommodative monetary policy, not taking full advance of ultra-low rates de facto amounts to working against the efforts of the monetary authorities which try to keep down the interest burden weighing on private and public debtors.

Why would AAA-rated treasuries that can issue debt at negative interest all the way up to 10 years want to pay comparatively higher coupons by issuing consols?

When the UK announced the redemption of the last consols in 2014, the head of multi-asset allocation at Threadneedle Asset Management argued “I hope that this move is the first of many to cut the interest bill and save taxpayers money” (Financial Times 2014). This divergence in funding costs is exemplified in Figure 2, which uses data provided by the Bank of England.

Figure 2 One century of Gilts, Consols and Bank of England Rates

Source: Bank of England

In fact, the ECB has deployed quantitative policies and negative rates precisely to ease financing conditions. Issuers with strong market access and low roll-over risk have no reason to go into consols, missing the opportunity to take advantage of the low, front-end interest rates. In a low-growth environment, lower funding cost are paramount for debt sustainability (Blanchard 2019).

Certainly aware of this, Soros proposal envisages a consol with a 0.5% coupon, which is close to current short rates for various euro area sovereigns. With such a coupon, however, it is unclear that there will be significant private demand. The 1927 UK consols retired in 2015 had driven private sector interest because their coupon was 4%. Which coupon would make sense for the markets today: 1%, 2%, higher?

Duration risk and the price of consols

Consols have a defining feature that makes them a risky fixed-income investment. The price of consols is extraordinarily sensitive to changes in the interest rates. This is referred to as having high duration, and it translates into potentially dramatic jumps in the consol’s mark-to-market price.

The price of a consol rests on two elements: its coupon c, and the discount rate r. The price is simply c/r, and its duration is the inverse of the interest rate, 1/r. Intuitively, discounting the future at a low interest rate assigns high values to distant payments.

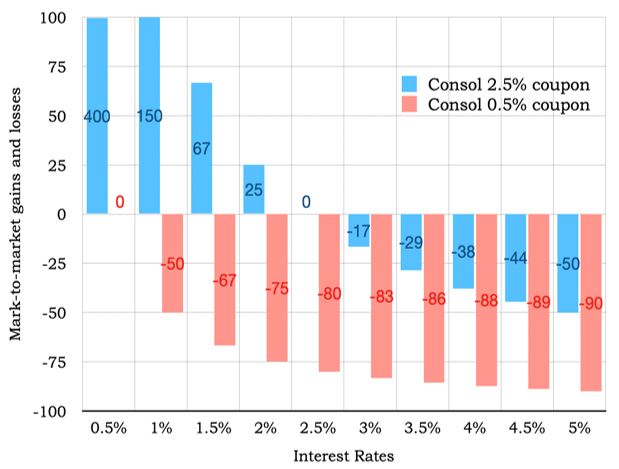

We illustrate the price sensitivity of consols to market rates in Figure 3, contrasting consols issued with a 0.5% coupon (as in Soros’ example) and consols paying a higher coupon of 2.5% (closer to the yield that can be expected on an EU consol, as we will explain below). As shown in this figure, suppose consols could be issued at par with a 0.5% coupon as proposed by Mr. Soros (if the coupon c equals r, the price of the consol is 1). If the reference market rate were to increase to, say, 2%, the price of the bond would go down to 25 cents! Conversely, if long-term interest rates were to drop further in the future, closer to zero, the price of a consol would increase sharply. In our example with a 0.5% coupon, if long-term yields were to drop to 0.1%, the value of the consol would multiply by 5. This would make it very expensive to buy them back in the future.

Figure 3 Duration risk of consols

Source: authors' own calculations. Gains and losses on €100 consol, issued at par, as interest rates change

The sensitivity of consols to interest rates makes them particularly risky for investors in a scenario where uncertainty about future interest rates is elevated. While interest rates are likely to remain at current historical lows for long, the unprecedented monetary stimulus can be expected to bring back some inflation over the medium-term, and, with it, higher interest rates. In view of the risk of an increase in future interest rates, investors would naturally demand an adequately high coupon.

In the case of a perpetual bond issued by the EU (a supranational entity), the coupon will naturally be based on the interest rate of risk-free instruments with the longest maturity available, plus some risk premium to account for the elevated duration risk of a consol. Under current monetary policy, as a reference, the 46-year French bond trades at a yield-to-maturity (YTM) of nearly 1%. In contrast, Italy’s 47-year bond trades at YTM of nearly 3%. The average spread between 50- and 10-year maturity bonds for A-rated (or higher) sovereigns stands at nearly 100 basis points (Bloomberg 5 May 2020) — a combination of term premium and rates expectations. Based on current market conditions, the coupon on a euro area consol could be reasonably set in the range of 2.0% and 3.0%.1 Therefore, the interest cost of a consol would be much higher than the market rates on shorter-maturity sovereign debt: 10-year French bonds are currently trading at just under 0% interest rate, and 10-year German bonds at -0.5%.

Moreover, a significant share of consols in the market could raise financial stability issues. Long-duration assets are likely to end up with insurance companies or pension funds that need to match long-term assets and liabilities. While these institutions should be better able to manage duration risk than other investors, the duration risk of consols is extremely high. The risk is that large prospective losses in the balance sheet of the institutions holding these instruments may weigh on the ECB’s willingness to normalize rates. Taking the proposal of Soros to illustrate the issue, if financial intermediaries were to buy €2 trillion in 0.5% coupon consols at par and if long-term rates move to 2%, the mark-to-market losses would amount to €1.5 trillion (Figure 3).

Two policy instruments: Joint European borrowing and lending

Strong issuers can afford to borrow short term at very low rates and engage in debt roll-over as debt matures, reducing the term premium they pay. The picture is different for weaker issuers. Weaker issuers face both higher borrowing costs and more uncertain future access to capital markets. For these issuers, using long maturity debt to finance long-term projects makes more sense. Matching the duration of assets and liabilities is a sound practice when refinancing risks are non-negligible.

The question is hence whether there is a way for Europe to allow all countries to benefit from matching long-term investment spending with shorter term liabilities? We argue that there is. The EU is a strong issuer which can use the asset and liability side of its balance sheet as two separate policy levers. European loans given to member states for support should be long maturity in order to improve debt sustainability and reduce near-term gross financing needs. Instead, the financing of the loans, through the issuance of EU bonds, should rely more on the front-end of the yield curve to take full advantage of ECB’s accommodative monetary policy. In other words, by using the two sides of its balance sheet wisely, the EU can deliver powerful ‘maturity transformation’ on behalf of its member states. Crucially, this exercise of maturity transformation is financed by borrowing countries, hence it does not rely on transfers or use of tax payers’ money from other countries.

To put it simply, the EU is best placed to take advantage of its status as a borrower with strong market access. The cheapest way to finance the European Recovery Fund would be to issue joint EU debt at shorter maturities, then pass those low interest rates onto member states through loans at low margins over funding costs and with very long maturities. Supporting member states through low rates and maturity transformation would further reinforce debt sustainability across all member states (Erce et al. 2020).

It is important to think of EU debt issuance and the provision of EU financing to member states as two separate policy instruments. As we are facing large and complex shocks challenging our capacity to stabilize the economy, we cannot afford the luxury of overlooking stabilization tools that can help us designing efficient and equitable solutions to the current European problems.

References

Alogoskoufis, S and S Langfield (2020), "Forever Europe: perpetual corona bonds to finance the recovery", Mimeo, 29 April.

Baldwin, R and B Weder di Mauro (2020), “Mitigating the COVID Crises: Act Fast and Do Whatever It Takes”, VoxEU.org, 18 March.

Blanchard, O (2019), “Public Debt and Low Interest Rates”, Peterson Institute for International Economics Working Paper 19-4.

Erce, A, A Garcia Pascual and R Marimon (2020), “The ESM can finance the Covid fight now”, VoxEU.org, 6 April.

Financial Times (2014), “UK to repay tranche of perpetual war loans“, 31 October.

Garicano, L (2020), “Toward a European Reconstruction Fund”, VoxEU.org, 5 May.

Giavazzi, F and G Tabellini (2020), “Covid perpetual eurobonds: jointly guaranteed and supported by the ECB”, VoxEU.org, 24 March.

Mihm, S (2019), “Never say never to forever bonds”, Bloomberg Opinion, 12 November.

Paris, P and C Wyplosz (2014), “The PADRE plan: politically acceptable debt restructuring in the eurozone”, VoxEU.org, 28 January.

Soros, G (2020), “The EU should issue perpetual bonds”, Project Syndicate, 20 April.

Verhofstadt, G and L Garicano (2020), “Toward a European Reconstruction Fund”, Project Syndicate, 15 April.

Endnotes

1 See Alogoskoufis and Langfield (2020) for further analysis on the pricing of consols.