..the build-up of systemic risks in the NBFI sector must be addressed before they reach a dangerous level ... This paper makes recommendations for tackling the structural vulnerabilities posed by NBFIs and their potentially dangerous ties with banks and the broader economy.

Whereas market financing is becoming increasingly important, structural vulnerabilities in the shadow banking sector remain unaddressed. To ensure that capital markets are a source of economic prosperity rather than financial instability, the European Commission in its new term should strengthen the macro-prudential framework for non-bank financial intermediation (NBFI). As developing and integrating Europe’s capital markets can help to provide innovative companies with risk capital, non-systemic NBFI entities should not be overburdened with micro-prudential regulation. However, the build-up of systemic risks in the NBFI sector must be addressed before they reach a dangerous level and central banks are forced to come to the rescue. This paper makes recommendations for tackling the structural vulnerabilities posed by NBFIs and their potentially dangerous ties with banks and the broader economy.

The importance of non-bank financial intermediation (NBFI) is growing. Tighter banking regulation following the global financial crisis, the desire to reduce the economy’s dependence on bank financing, as well as more than a decade of low interest rates have resulted in a bigger share of NBFI within the global financial system. With the EU striving for a capital markets union, this trend is set to continue. Although no silver bullet, capital markets can contribute to narrowing Europe’s investment gap by helping to divert funds from mid-tech, old industries towards innovative start-ups and scale-ups. However, the integration of markets can also bring with it new risks to financial stability. The dash for cash in 2020 or the UK gilt crisis in 2022 required extraordinary central bank interventions, such as the purchase of non-financial commercial paper and the extension of lending operations, to restore market functioning. These cases highlighted structural vulnerabilities in the NBFI sector and revealed the limits of micro-prudential regulation – that merely enhances entity-level resilience – in guaranteeing system-wide financial stability.

To realise the benefits of the capital markets union (CMU), it is vital that market-based financing is a resilient and sustainable source of funding. While individual NBFI entities may not be of systemic importance, their collective actions may generate systemic risk. When several players implement similar strategies, this could transmit and amplify adverse shocks to the rest of the financial system and the real economy, particularly in times of market stress. To assess the adequacy of macro-prudential policies for NBFI, the European Commission recently gathered feedback from stakeholders in a targeted consultation. This paper argues that with the growth of NBFI and its potential systemic relevance, the EU should urgently address any structural vulnerabilities and implement an effective macro-prudential policy framework for NBFI. Preventing the build-up of systemic risks is the precondition for market-based financing to boost the European economy and exploit the full potential of the Savings and Investments Union.

1 The rise of NBFI

The NBFI universe is very heterogeneous. NBFIs comprise very diverse sectors, including asset management companies and investment funds, family offices, brokers, dealers, pension funds, insurance companies, and other non-bank entities (Figure 1). These different entities have diverse business models and are subject to different regulatory frameworks. Some of these entities act as agents on behalf of their clients, e.g. asset managers, while others, such as insurers, hold assets on their own balance sheet. While the Financial Stability Board (FSB) has developed a negative definition with NBFIs viewed as all financial institutions that are not central banks, banks, or public financial institutions, there is no clear-cut definition for some NBFI entities, such as family offices.

Figure 1: Major players in the NBFI universe

Source: Own illustration.

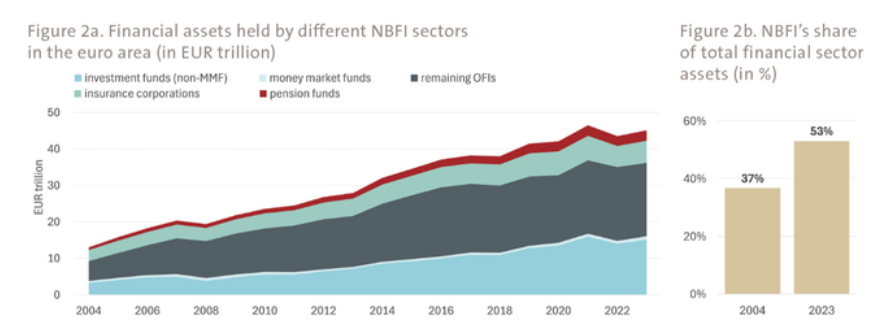

Since the global financial crisis of 2007/2008, the NBFI sector has massively increased its footprint. This represents a long-term structural trend, but also results from the retreat of banks in response to stricter regulations. Within the eurozone, the NBFI sector more than tripled from €13 trillion in 2004 to €45 trillion at the end of 2023 (Figure 2). In the same period, the NBFI’s share of total financial sector assets increased from 37% to 53%. The expansion of the NBFI sector has been mainly driven by other financial institutions and collective investment vehicles, which include a variety of institutions such as hedge funds, money market funds, and fixed income funds, that are engaged in activities involving significant liquidity and maturity transformations.

Delors Centre

full paper

© Jacques Delors Centre

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article